Archive

Australian housing bubble about to be pricked by Fitch

The Australian housing market has been in a dreamland Ponzi bubble for 30 years. The leverage has been astonishing. The debt levels gigantic. Prices have to come down around 40% to be sustainable, viable and functional.

What would that do to our banks?

Fitch is about to tell us.

AUSTRALIAN banks face fresh scrutiny over their exposure to the frothy housing market, with a key ratings agency planning a stress test to assess what sort of impact a sudden collapse in property prices would have on their lending books.

Ratings agency Fitch will run several shock scenarios ranging from mild to severe. In the worst-case scenario, Fitch will assess what is likely to happen to bank ratings if mortgage defaults rise as much as 8 per cent and property prices fall a hefty 40 per cent.

The results will also be used to assess implications for mortgage-backed bonds sold by banks and other lenders.

The Reserve Bank will this morning provide its half-yearly financial stability review, with the health of the residential property market likely to come under focus.

For months, Australian banks and analysts have been debating whether the property market is starting to look like a bubble, but details of the Fitch stress test were enough to spook investors, with bank shares taking a sudden negative turn yesterday afternoon.

Shares in Commonwealth Bank and Westpac, which have the largest exposure to residential property, yesterday closed down 1 per cent and 1.3 per cent respectively.

Fitch’s managing director for Australia, Ben McCarthy, said the ratings agency had received ”numerous inquiries” from investors about the sustainability of Australian residential property prices and the possible impacts of a correction.

“While over the short-to-medium term, a downturn is not Fitch’s central expectation, the agency is performing its stress test exercise on ratings impact under the hypothesis of an imminent housing market correction.”

Australia’s capital city home prices have risen 41 per cent since June 2006, on official Australian Bureau of Statistics data. Over the same period, prices plunged in the US, Britain, Ireland and Spain.

With an estimated 60 per cent of Australian banks’ loan books secured by residential property, international investors have questioned the sustainability of house prices.

Commonwealth Bank chief executive Ralph Norris has recently embarked on an international roadshow aimed at heading off concerns that the Australian property market is behaving like a bubble.

CLSA analyst Brian Johnson is a supporter of the bubble thesis, warning prices could fall if interest rates move higher later this year. He has said the first-home buyer segment is particularly vulnerable.

Hedge funds have also been circling bank stocks, betting the market was overvalued and a collapse in prices would cause steep losses for banks.

Xerographica is a genius!

Another great graph from that WP genuis Xerographica:

‘This will not end until the Anglo bankers are dead and denutted’

The. End. Is. Nigh.

It hath been foretold.

The ‘mad’ goldbugs were right after all…

Ambrose Evans-Prtichard of the Telegraph apologizes to all the ranting, insane, paranoid conspiracy goldbug ‘nuts’ for being wrong about Bernanke. Yes, he says, Bernanke is nuts.

Best quote of the week: You cannot solve a structural unemployment crisis with loose money.

So all those hillsmen in Idaho, with their Colt 45s and boxes of krugerrands, who sent furious emails to the Telegraph accusing me of defending a hyperinflating establishment cabal were right all along. The Fed is indeed out of control.

The sophisticates at banking conferences in London, Frankfurt, and New York who aplogized for this primitive monetary creationsim – as I did – are the ones who lost the plot.

My apologies. Mercy, for I have sinned against sound money, and therefore against sound politics.

I stick to my view that Friedmanite QE ‘a l’outrance‘ is legitimate to prevent a collapse of the M3 broad money supply, and to prevent outright deflation in economies with total debt levels near or above 300pc of GDP. Not in any circumstances, but where necessary, and where conducted properly by purchasing bonds outside the banking system (not the same as Bernanke “creditism”).

The dangers of tipping into a debt compound trap – as described by Irving Fisher in Debt-Deflation Theory of Great Depresssions in 1933 – outweigh the risk of an expanded money stock catching fire and setting off an inflation surge later. Debt deflation is a toxic process that can and does destroy societies as well as economies. You do not trifle with it.

But deliberately creating inflation “consistent” with the Fed’s mandate – implicitly to erode debt – is another matter. Nor can this be justified at this particular juncture. M3 has been leveling out. M2 has begun to rise briskly. The velocity of money has picked up. The M1 monetary mulitplier has jumped.

We have a very odd world. The IMF has doubled its global growth forecast to 4.5pc this year, and authorities everywhere have ruled out a serious risk of a double dip recession.

Yet at the same time the Bank of Japan has embarked on unsterilised currency intervention, which amounts to stimulus, and both the Fed and the Bank of England are signalling fresh QE.

You can’t have it both ways. If the US is not in deep trouble, the Fed should not be thinking of extra QE. It should step back and let the economy heal itself, if necessary enduring several years of poor growth to purge excess leverage.

Yes, U6 unemployment is 16.7pc. But as dissenters at the Minneapolis Fed remind us, you cannot solve a structural unemployment crisis with loose money.

Fed is trying to conjure away the hangover from the last binge (which Greenspan/Bernanke caused, let us not forget), as if to vindicate its prior claim that you can always clean up painlessly after asset bubbles.

Are the Chinese right? Are the Americans and the British now so decadent that they will refuse to take their punishment, opting to default on their debts by stealth?

Sooner or later we may learn what the Fed’s hawkish bloc of Fisher, Lacker, Plosser, Hoenig, Warsh, and Kocherlakota really think about this latest lurch into monetary la la land, with all that it implies for moral hazard and debt contracts.

If I have written harsh words about these heroic resisters, I apologise for that too.

Mr Bean’s monetary adventures

Mr Bean is an idiot. But you already know that.

Older households could afford to suffer because they had benefited from previous property price rises, Charles Bean, the deputy governor, suggested.

The average person is saving £102 a month, down from £130 in February, according to Santander.

They should “not expect” to live off interest, he added, admitting that low returns were part of a strategy.

His remarks are likely to infuriate savers, who are among the biggest victims of the recession. About five million retired people are thought to rely on the interest earned by their nest-eggs. But almost all savings accounts now pay less than inflation.

The typical savings rate has fallen from more than 2.8 per cent before the financial crisis to 0.23 per cent last month.

Mr Bean said he “fully sympathised”. But he continued: “Savers shouldn’t necessarily expect to be able to live just off their income in times when interest rates are low. It may make sense for them to eat into their capital a bit.”

He added: “Very often older households have actually benefited from the fact that they’ve seen capital gains on their houses.”

In an interview with Channel Four News last night, he said that savers “might be suffering” from the low Bank Rate. But they had done well from higher rates in the past and would do so again.

Mr Bean said that encouraging Britons to spend was one reason why the Bank had cut interest rates. They have been held at 0.5 per cent for 18 months, hitting rates offered on savings accounts.

The strategy had led to Mervyn King, the governor, receiving many letters of complaint.

But it was designed to return the economy to a reasonable level of activity as quickly as possible, he said. “The faster we can achieve that, the sooner interest rates will get back to more normal levels.”

Had the Bank not acted, “unemployment would have been higher, wage growth would have been lower,” Mr Bean added.

The comments angered groups representing the elderly and those putting money aside. The Daily Telegraph has campaigned for protection for savers.

Ros Altmann, director-general of Saga, said: “Savers are being taken advantage of. They did the right thing and have been let down at the other end of the deal.

“I don’t think this is what most people would consider fair.”

Dot Gibson, of the National Pensioners Convention, said: “For years we’ve been told to put money aside for our retirement only to find that interest rates have sunk and now we have to use our savings just to pay the bills.”

Jason Riddle, of Save Our Savers, said: “The Bank was aware that there was a lack of saving before the financial crisis, but those who were prudently saving while others spent, are being heavily punished.”

Official figures show that savers have lost about £18 billion a year in interest as a result of the Bank’s response to the worst recession in a generation.

The amount Britons save has fallen by more than a fifth since the start of the year, a survey showed today.

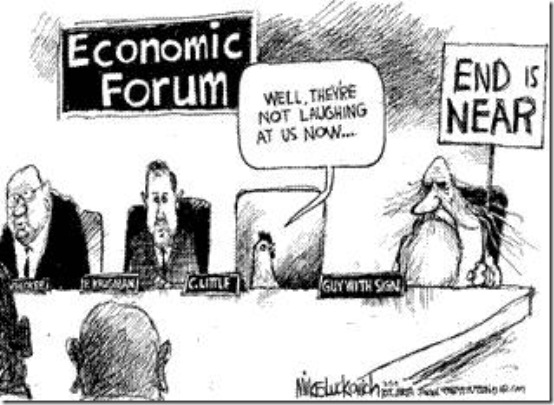

Jaws of Death

Great article on why the End is Near here. And a cute cartoon too. Bonus.

Why gold is a no-brainer

From the UK’s Daily Telegraph:

Surely the Fed has not become so reckless that it really aims to use emergency measures to create inflation, rather preventing deflation? This must be a cover-story. Ben Bernanke’s real purpose – as he aired in his November 2002 speech on deflation – is to weaken the dollar.

If so, he has succeeded. The Swiss franc smashed through parity last week as investors digested the message. But the swissie is an over-rated refuge. The franc cannot go much further without destabilizing Switzerland itself.

Gold has no such limits. It hit $1300 an ounce last week, still well shy of the $2,200-2,400 range reached in the late Medieval era of the 14th and 15th Centuries.

This is not to say that gold has any particular “intrinsic value”’. It is subject to supply and demand like everything else. It crashed after the gold discoveries of Spain’s Conquistadores in the New World, and slid further after finds in Australia and South Africa. It ultimately lost 90pc of its value – hitting rock-bottom a decade ago when central banks succumbed to fiat hubris and began to sell their bullion. Gold hit a millennium-low on the day that Gordon Brown auctioned the first tranche of Britain’s gold. It has risen five-fold since then.

We have a new world order where China and India are buying gold on every dip, where the West faces an ageing crisis, and where the sovereign states of the US, Japan, and most of Western Europe have public debt trajectories near or beyond the point of no return.

The managers of all four reserve currencies are playing fast and loose: the Fed is clipping the dollar; the Bank of England is clipping sterling; the European Central Bank is buying the bonds of EMU debtors to stave off insolvency, something it vowed never to do just months ago; and the Bank of Japan has just carried out two trillion yen of “unsterilized” intervention.

Of course, gold can go higher.

America is dead

Max Keiser says, ‘Put a fork in it’.

I agree.

The real reason why establishment economists scream for deficit spending during a downturn

We all know that Paul Krugman’s ‘solutions’ to solve the so-called ‘liquidity trap’ problem don’t work.

We all know that piling on more government debt on top of personal debt to solve problems of debt is insanity. We all know that there’s much more debt than money to pay off the debt. We all know it’s impossible, it’s unsustainable, it’s doomed. We all know this thing is designed to implode. We all know deficit spending distorts the market and creates huge economic problems.

So why does the mainstream economic community support it? Why do governments support it? Why do banks support it?

In a crisis, the banks need government debt to stay solvent. Because of the madness of fractional reserve banking, the only debts that are almost impossible to default on are government debts, because the government has the power to print the nominal fiat currency. So when there’s a rush for liquidity in a banking collapse, demand for ‘secure’ govt bonds soars. Witness the GFC and witness the new Basel III rules.

Ironically Australia has too little govt debt to keep the Australian banks ‘solvent’ in a liquidity crisis. Ironically, the Australian banks are calling for the Federal government to go deeper into unrepayable debt in order for them to satisfy the Basel III rules on capital adequacy.

The madness of this system is lost on everyone but the Austrian economists.

Leaving aside the inherent madness of the system, the point is this: In order to keep the banks alive, the government must go deeper into debt.

When you next hear Paul Krugman screaming for deficit spending remember why he is screaming for deficit spending. He is really screaming for more govt bonds to keep the banks solvent.

It destroys the real economy. It’s madness. It’s completely unsustainable. But it keeps the vampire banks alive.

Simple.

So, when faced with a recession, sell shares and buy government bonds. The established bankers do exactly the same thing. Why try to fight the receding tide and the corrupt banking system.

SPLAT!!!!

James Quinn tells it like it is:

The only thing that could possibly keep foreigners buying our debt would be higher interest rates. Our economy is so saturated with debt from top to bottom, that an increase in interest rates of only 2% would have a devastating impact on our economy. John Hussman understates the impact of deficits on our economic future:

Continued deficits will have substantial economic consequences once the savings rate fails to increase in an adequate amount to absorb the new issuance, and particularly if foreign central banks do not pick up the slack. We’re not there for now, but it’s important not to assume that the current period of stable and even deflationary price pressures is some sort of structural feature of the economy that will allow us to run deficits indefinitely.

The Krugmans of the world are not worried about our debt. They say pile it on. We are America. We are the most powerful nation in the history of the world. We can obliterate any enemy with the push of a button. Why do we need to worry about some debt? This is the hubris that has led to the downfall of every great Empire. As Rogoff and Reinhart point out in their recent book, this time is not different:

“As for financial markets, we have come full circle to the concept of financial fragility in economies with massive indebtedness. All too often, periods of heavy borrowing can take place in a bubble and last for a surprisingly long time. But highly leveraged economies, particularly those in which continual rollover of short-term debt is sustained only by confidence in relatively illiquid underlying assets, seldom survive forever, particularly if leverage continues to grow unchecked.

“This time may seem different, but all too often a deeper look shows it is not. Encouragingly, history does point to warning signs that policy makers can look at to assess risk – if only they do not become too drunk with their credit bubble – fueled success and say, as their predecessors have for centuries, “This time is different.”

A tipping point is reached when the government debt exceeds 90% of GDP. US government debt is currently at 93% of GDP. One year from now it will exceed 100% of GDP. The bastard child of the mother of all bubbles has jumped out a window on the hundredth floor of a NYC mega bank. As he passes the 50th floor, Paul Krugman asks him how is he doing? He says great, SO FAR. We all know what happen next. SPLAT!!!!

America is dying of monetary cancer

Steve Keen votes ‘Ice’

The debate between Fire (inflation) and Ice (deflation) has been going on for months now.

Everyone is missing the reality that there is bi-flation: deflation in previously over-leveraged asset markets of all types; inflation in essential consumable (but non-renewable) commodities such as food, water and gold.

Steve Keen presents the most cogent argument for continued asset price deflation here in his most recent piece on his blog.

But he assiduously avoids discussing food price inflation or the gold price. I wonder how these anomalies fit into his worldview?

Perhaps they don’t…

Why gold is hated and ignored by the mainstream, but coveted in private

Brilliant piece by Gary North:

The arguments against gold all stem from one idea: that private property is insufficient to establish a reliable monetary system. All of the arguments, without exception, rely on one version or another of a rival idea: central governments must intervene in the market for gold and silver in order to provide a reliable monetary unit. When I say government, I also mean the government-licensed monopoly that we call the central bank.

All opponents of a gold coin standard adopt some version of the anti-free-market ideology. They may be free-market people in other areas of their thinking, but in the area of monetary policy, they do not trust the free market. They do not trust individuals who act in their own self-interest, and who establish voluntary contracts with other individuals.

This is certainly true of the monetarists. The monetarists, following the arguments of Milton Friedman, have always opposed the idea that individuals are sufficiently reliable, trustworthy, and knowledgeable to make their own decisions about what kinds of money are best for them.

The monetarists have always opposed the standard free-market argument that individuals who pursue their own self-interest are capable of making their own decisions. These monetarists also oppose the idea that the decisions of individuals relating to their choice of a monetary standard will produce, collectively, a reliable monetary system.

This hostility to free-market money is opposed to the official position of the monetarists with respect to other aspects of the market economy. Some of them believe in antitrust laws. Some of them do not. But all of them believe that the central bank, when backed up by the power of the Federal government, is the only reliable institution with respect to the establishment of the fundamental policies governing monetary policy. These people trust the central bankers.

When you find scholars who oppose the full gold coin standard, you can be certain that these men do not really believe in free market. They believe in it for some areas of the economy, but they do not believe in it with respect to the central institution of all economic decision-making in a modern economy: the money system. They believe in government, which means they believe in coercion. They believe that somebody with a badge and a gun has the right to stick that gun in the belly of a decision-maker and demand that this individual use the money provided by the central bank.

Because academic economists are overwhelmingly Keynesians, and because a minority are monetarists, they believe in the legitimacy and wisdom of people who carry badges and guns. They believe in coercion in the area monetary policy, and they recognize that gold is the greatest single threat to government coercion that there is.

Individuals make decisions day after day, in almost every area of their lives, by using money. They establish the rules of the game on their own authority. Most people will never think of getting their hands on a gun in order to fight the central government. But in their daily decision-making, in the free market, they establish their own authority over government activities by means of the monetary system.

Control over governments by people who have the right to make exchanges in terms of non-government, non-central bank monetary systems is a crucial control over government. This is because such control is constant. Using gold coins is not self-consciously a means of exercising control over government, but it functionally is control over government. It forces the government to restrict its spending and its taxing as no other single legal right possessed by citizens and non-citizens.

This is why the overwhelming opinion of the opinion-makers in the modern world is opposed to a full gold coin standard. The reason for this is that the overwhelming opinion of the opinion-makers is in favor of government power. The individuals who openly favor the establishment of a full gold coin standard are in opposition to the dominant outlook of the intellectual world

This is why the overwhelming opinion of the opinion-makers in the modern world is opposed to a full gold coin standard. The reason for this is that the overwhelming opinion of the opinion-makers is in favor of government power. The individuals who openly favor the establishment of a full gold coin standard are in opposition to the dominant outlook of the intellectual world.

Through the looking glass

The UK’s Daily Telegraph reports that the Fed will ‘look through’ any spike in agflation to continue their ultra-loose monetary policy. ‘Look through’? Or ‘ignore’?

There is a widely-held view that roaring “agflation” and record gold prices signal inflation, evidence that ultra-loose monetary policy in the US and Europe is leaking excess liquidity into the world. Japan is the latest country to boost liquidity, launching “unsterilised” yen sales.

However, this year’s spike is narrower. Crude oil is at $75 a barrel, half the 2008 peak. The CRB commodity index is back to 2004 levels. Natural gas prices have fallen this year. Copper has surged, but other base metals have lagged. While gold is in vogue, this is partly due to diversification out of euros and dollars by Asian governments, and loss of faith in Western leadership.

Central banks must make a tricky judgement call, deciding whether food shortages are inflationary or deflationary. They can be either. Policy makers in the US and Europe misread the commodity spike of 2008 as the start of a 1970s inflation spiral, when in reality it sapped broader demand. Central banks tightened policy, just as their economies were buckling. The financial system crashed two months later. Inflation collapsed in short order.

The US Federal Reserve does not want to repeat that mistake. Its minutes this week warned of “downside risks” to inflation. The message is clear: the Fed plans to steel its nerves this time and “look through” any spike in resource costs.

What’s going to happen is…

…this:

Unsustainable debt isn’t self-equilibrating, but gold is…

Libertarianism for Dummies

All you need to know. Credit goes to Xerographica from WP.

Summer of our discontent

Lawrence Summers is to resign his government post and return to Harvard at the end of the year.

Ice

Ellen Hodgson Brown votes ‘Ice’:

What precipitated the credit crisis and bank bailout of 2008 was not that the existing Basel II capital requirements were too low. It was that banks found a way around the rules by purchasing unregulated “insurance contracts” known as credit default swaps (CDS). The Basel II rules based capital requirements on how risky a bank’s loan book was, and banks could make their books look less risky by buying CDS. This “insurance,” however, proved to be a fraud when AIG, the major seller of CDS, went bankrupt on September 15, 2008. The bailout of the Wall Street banks caught in this derivative scheme followed.

The smaller local banks neither triggered the crisis nor got the bailout money. Yet it is they that will be affected by the new rules, and that effect could cripple local lending. Raising the capital requirements on the smaller banks seems so counterproductive that suspicious observers might wonder if something else is going on. Professor Carroll Quigley, an insider groomed by the international bankers, wrote in Tragedy and Hope in 1966 of the pivotal role played by the BIS in the grand scheme of his mentors:

“[T]he powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations.”

The BIS has now become the apex of the system as Dr. Quigley foresaw, dictating rules that strengthen an international banking empire at the expense of smaller rivals and of economies generally. The big global bankers are one step closer to global dominance, steered by the invisible hand of their captains at the BIS. In a game that has been played by bankers for centuries, tightening credit in the ebbs of the “business cycle” creates waves of bankruptcies and foreclosures, allowing property to be snatched up at fire sale prices by financiers who not only saw the wave coming but actually precipitated it.

Biflation

Fire or Ice? Perhaps both?

I have discovered a new term for what is going on in the markets today: Biflation.

This involves deflation in previously over-leveraged asset markets and inflation in commodity markets.

Liquidity is pouring through markets. It’s just not going where is used to go. It’s going straight to Asia and the banks. And what do they want? Gold. And food. And every other soft commodity and metal known to man.

See Doug Noland‘s take on this new biflation phenomenon below. He tends towards Fire more than Ice, and, at the end of all this, he will be proven right.

One could argue that policymakers had also succumbed to a bout of complacency earlier in the year. The Federal Reserve and ECB had their sights on reducing stimulus and implementing so-called “exit strategies.” Market tumult and attendant recovery fears now have American and European central bankers (indefinitely) focused intensively on quantitative easing and additional measures to assure the markets that liquidity will remain in ongoing abundance.

To this point, contagion effects from Ireland and Portugal have been minimal. I’ll assume that this is explained by today’s reduced systemic vulnerability to a more cautiously positioned leveraged community coupled with the availability of ECB market liquidity support mechanisms. Over recent months, buying from the Chinese and sovereign wealth funds have also bolstered European debt markets. And there is certainly the perception that any development that risks heightened systemic stress would be met head on by Federal Reserve Monetization (“quantitative easing”). Recent and prospective dollar weakness has buoyed euro sentiment, which works to restrain de-risking, contagion effects and bouts of self-reinforcing de-leveraging (for now).

At home and abroad, there are indications of extraordinary marketplace liquidity abundance.

Today from Bloomberg: “Speculative-grade companies are selling leveraged loans at the fastest pace this year to pay for acquisitions and buyouts led by Carlyle Group as prices of the debt climb to a four-month high.” This morning from the Wall Street Journal: “One of the markets at the heart of the credit bubble has surged back with surprising speed as investors chasing yield are increasingly willing to finance riskier companies. Poster children of the mid-2000s credit bubble, leveraged loans are set to have their busiest year since 2008.” Also today from Bloomberg: “Average prices on high-yield debt rose above 100 cents on the dollar yesterday for the first time since June 2007 after falling as low as 55 cents in December 2008…” According to Bloomberg, this week’s $41.7bn of corporate bond issuance combined with about an equal amount from last week pushed two-week debt sales to the strongest level this year. With more than three months to go, year-to-date junk issuance is already well into new record territory.

In the face of enormous supply, corporate bond yields have remained extraordinarily low. Investment grade spreads (IBOX) were little changed this week at 104 bps, while junk spreads (IBOX) narrowed 8 to 546 bps. California Credit default swap prices fell 8 bps this week to 284 bps. Emerging market spreads increased 3 this week to 300 bps. Financial Conditions – while susceptible – remain loose.

The Japanese moved aggressively this week to stanch the yen’s rally. Japanese stocks surged. In China, the talk was of additional government measures to slow Credit growth and to contain mounting inflationary pressures. Chinese shares fell. The Reserve Bank of India raised rates for the fifth time this year (to 6.0%), as it continues to do battle with inflationary pressures. Shares, nonetheless, surged.

Here at home, those arguing that deflation holds sway as the prevailing risk have, for now, won the “debate” both in policymaking circles and in the bond market. All the same, watering down the analysis to some black or white “inflation or deflation” issue misses the complexity of risks today confronting an imbalanced global economy and unstable financial “system.” Clearly, much of the world (China, India, Argentina, Brazil, Russia and non-Japan Asia, to mention just a “few”) faces mounting inflation problems. And if global markets don’t succumb to another period of de-risking and de-leveraging, it’s going to be fascinating to follow developments as global liquidity excess interplays with the robust inflationary biases that have taken hold throughout the “developing” economies/markets.

In the face of this week’s Japanese currency intervention and European debt worries, the dollar was notably unimpressive. Momentum building for additional quantitative ease is dollar unfriendly, especially with marketplace liquidity already overabundant. The last thing an unsettled world needs more of right now is additional dollar liquidity flows.

To be sure, prospective Treasury purchases will have much different effects than the Fed’s Monetization of MBS, GSE debt and Treasurys had back in late-2008/early-2009. That period’s massive expansion of Fed assets was executed in the midst of an unprecedented unwind of leveraged speculations. In particular, the Fed’s Monetization occurred during the reversal of “dollar carry” trades, where unwind of bearish dollar positions incited a huge dollar rally and liquidity shortfall. Moreover, the Fed’s ballooning balance sheet back then accommodated speculator (i.e. Lehman, hedge funds, etc.) de-leveraging. It was not a case of massive amounts of new liquidity being unleashed upon global markets.

Going forward, one can envisage a scenario where “QE2” is implemented right into a backdrop of faltering dollar confidence. In such a scenario, Fed-created liquidity just might seek an immediate exit from the dollar – only exacerbating both dollar fragility and general Monetary Disorder. It’s reasonable that one facet of such a scenario would have the Japanese, Chinese and other central banks buying/Monetizing an increasingly problematic global surfeit of dollars – creating additional destabilizing liquidity in the process. And, having watched the way things have tended to unfold, I would see a rising tide of Competitive Monetization as a high probability development.

Is the dollar a bigger story than Ireland and Portugal? Perhaps a rapidly rising tide of liquidity has something to do with Gold’s run toward $1,300. Such a scenario might also help explain surging prices for silver, copper, wheat, corn, rice, soybeans, cattle, hogs, sugar, cotton, coffee, cocoa, etc. And, for awhile, liquidity excesses might even continue to inflate global bond prices. But if this is deflation, it’s an abnormally strange strain.

Why gold?

Gold reacts to many things not seen by the mainstream. It reacts to the extreme distress of the creaking dying financial system. It reacts to the failure of debt denominated monetary system. It reacts to the insolvent US Federal Reserve. It reacts to the moribund environment for capital formation. It reacts to the debt saturation. It reacts to the burgeoning federal deficits. It reacts to the 20 months of 0% that cannot kickstart the USEconomy. It reacts to the still declining housing market. It reacts to the tragic march of home foreclosures. It reacts to the tragic march of the unemployed. It reacts to the 20% of the homes mired in negative equity. It reacts to the reluctance to serve remedy, reform, or restructure by the big banks who have the USGovt finance ministry in a choke hold. It reacts to the wars that exhibit a cancer upon the presidency. It reacts to the absence of industrial base, dispatched to Asia. It reacts to the hidden lack of comprehension for the consequences of unsound money. It reacts to the ugly aftermath following two decades of falsely priced cost of money. It reacts to the failed central bank franchise system. It reacts to the end of the road for additional bubbles to blow on the American landscape. It reacts to the growing despair extended from the dark clouds hanging over the current environment. It reacts to the lack of comprehension of money itself by the brain trust posing as bank leaders. It reacts to the lack of comprehension of economics itself by the brain trust posing as economists.

Gold is f*cking exploding!

Slow down. I can’t buy this sh*t fast enough!!!

A mainstream newspaper talks about full reserve banking!

You could have knocked me over with a feather when I read this.

Wow.

It’s not that 72% of idiots think they own the money they put in the bank. It’s that a mainstream daily would even mention this topic.

This is a first. Hopefully not a last.

I hate Michael Pascoe

I hate Michael Pascoe because he is a paid for shill for the Establishment and is a shameless anti-gold man.

His latest piece in the mainstream SMH:

While well down from its peak, there’s no denying Australian dollar gold has still done nicely indeed since it took off from below $600 five years ago. To pick a random starting point, Aussie gold is up 10.6 per cent this year – not as flash as the US dollar rise of 16 per cent, but still better than equities and much better over the five-year time frame.

Before that though, gold wasn’t doing much and past performance of course does not guarantee etc. Gold’s current strength doesn’t mean it’s not a bubble. Indeed, it’s rallying because it is bubbling – speculative momentum building on top of cheap money and fear. Physical demand for gold used to be about jewellery and industrial use, but now is mainly for speculation.

(This of course is fluoro red rag stuff to the gold bugs, many of whom believe there is some intrinsic value in the yellow metal and some of whom think capitalism is about to come to an end. But perhaps the most curious justification I’ve seen for buying gold was attributed to the seriously rich and eccentric Jim Rogers, that it has further to go because it’s still well down on its inflation-adjusted 1980 peak of $US2300 – in which case tulip bulbs should be in for quite a surge one of these centuries.)

There’s a lot of money to be made riding a bubble trend – as long as you have the prescience to jump off before it pops. The North Atlantic economies and their management will have to be in better shape before the pin comes looking for gold, but it’s the nature of such popping that it’s very quick when it does happen, making it extremely difficult to jump clear of the wreckage.

His arguments apply to the Oz housing bubble, not to gold. When fiat paper is being printed in the trillions to save banks, it’s hardly surprising that ‘real’ money rises in value. It’s not so much that gold is going up as it is fiat money that is going down.

If he thinks gold – inherently limited supply, perfectly liquid, inflation-proof – is in a bubble, what does he think of Oz house prices? Massively leveraged on historically low interest rates, govt-subsidized pricing, artificially held up by all sorts of financial supports, teetering on a cliff of over-leverage…

The ‘private’ bank-coercive state nexus has become a parasitic, corrupt malignant growth on the real economy

Yves Smith hits it out of the park in this piece from her Naked Capitalism blog. She laughs at Basel III and states the obvious: the banks are effectively socialist organisations that are part of the corrupting, corroding machine of the State.

A juicy quote:

The usual narrative, “privatized gains and socialized losses” is insufficient to describe the dynamic at work. The banking industry falsely depicts markets, and by extension, its incumbents as a bastion of capitalism. The blatant manipulations of the equity markets shows that financial activity, which used to be recognized as valuable because it supported commercial activity, is whenever possible being subverted to industry rent-seeking. And worse, these activities are state supported.

Consider Fannie and Freddie pre-conservatorship. They were at least branded more accurately as “government sponsored enterprises” and “agencies” making their public/private role explicit. Yet they were over time allowed more and more latitude to act as private enterprises, particularly as far as employee pay was concerned. We know how that movie ended.

Consider now the banking industry. Admittedly, banks do not fund at the tight spreads over Treasuries that Freddie and Fannie enjoyed pre-crisis, and regulators are trying to convince investors and the broader public that they will allow big banks to be resolved and are prepared to impose losses on bondholders, but does anyone believe this will happen? Winding down even a medium sized broker-dealer is a market-disrupting activity, and the “living wills” requirement looks like window dressing. But aside from the saber rattling of Pimco about why bondholders needed to be spared any pain, we also heard troubling rationalizations, such as bank bonds are held by pension funds. Well, yes, it’s risk capital. Investors are supposed to diversify holdings and losses are part of the game. And perhaps most important reason during the crisis for not cramming down bondholders was fear of contagion: imposing losses on bondholders of one bank would lead bondholders of other at-risk firms to run for the exits, raising their funding costs and potentially putting them in a death spiral.

So, the reality is that banks can no longer meaningfully be called private enterprises, yet no one in the media will challenge this fiction. And pointing out in a more direct manner that banks should not be considered capitalist ventures would also penetrate the dubious defenses of their need for lavish pay. Why should government-backed businesses run hedge funds or engage in high risk trading, or for that matter, be permitted to offer lucrative products that are valuable because they allow customers to engage in questionable activities, like regulatory arbitrage? The sort of markets that serve a public purpose should be reasonably efficient and transparent, which implies low margins for intermediaries…

Ambrose Bierce, in The Devil’s Dictionary, described a partnership as “When two thieves have their hands so deeply plunged into each other’s pockets that they cannot separately plunder a third party.” Pointing out that banks are de facto partners of the state, enjoying substantial privileges (that unlimited checkwriting on official coffers when things go bad, the ongoing subsidies, the lavish private sector pay) without commensurate duties opens a huge can of worms. It goes beyond the usual, relatively anodyne “privatized gains and socialized losses” and opens up the terrain of “What do we mean by private enterprise?” Part of the American ideology is that there is a hard line between government and business. But entire industries suck off the state with far too few strings attached. The black/white distinction is illusory; what we instead have is a gradient.

But looking hard at the degree of looting and abuse of taxpayers, particularly in light of lavish CEO pay, not only raises uncomfortable questions, but calls for remedies that are politically unpalatable. Even though the state is deeply involved in enterprise, our ideology is that explicit industrial policy or other forms of involvement is a bad thing, the government will screw it up (when in fact some foreign governments do a decent job but we’d never deign to learn from them). So we’d rather limp along with a defective and increasingly costly model than challenge deeply held political beliefs.

Q: Will there be enough food? A: No chance in Hell

Gerald Celente, a recognized world trend-spotter, has been cited by the NY Post, CNN, and USA Today. His predictions of future trends based on current events have been recognized as incredibly accurate, in both the world of politics and finances.

The current trends cited include increased governmental control of food production and distribution, reduced bank solvency and increased credit regulations. Other trends include ongoing disasters such as the recent 20% food price hike in Russia and the devastating flooding in Pakistan, which destroyed the entire cotton crop for the nation.

As an example of increasing government control, Off The Grid News cites an incident in Portland, Oregon (among many others), in which a child’s lemonade stand was shut down because it was unregulated by the government and the child had not paid the $120 fee to do business in the city. These trends, in conjunction with legislation like the Food Safety Modernization Act S510, paint a very bleak picture of the future.

Emerging trends indicate immense food shortages in the near future, beginning with farmers taxed beyond endurance. Add to this the looming specter of war in the Middle East, rising gas and fertilizer costs, and you have a recipe for rising food prices.

To listen to Celente’s newest comments on food supplies and rising food prices, go here.

I have nothing further to add. Other than to say I told you so.

Fire

This debate is getting heated (excuse the pun). Pento again argues “Fire”. MISH has argued “Ice”. I don’t know who to believe.

But both scream GOLD.

On Pento’s arguments, I extract part of his piece below:

With interest rates having been so low for so long, it’s understandable that many people have forgotten that central banks are not ultimately in control of interest rates. It is true that the Fed can be highly influential across the yield curve and can be especially effective in controlling the short end. But, in the end, the free market has the last word on the cost of money.

Although the Fed has certainly created enough new dollars to send prices higher, recessionary forces are, for now, disguising the evidence of runaway inflation. But when inflation finally erupts into the daylight, it will be impossible for borrowing costs to stay low. No one can realistically be expected to loan money below the rate of inflation. To attract buyers, the Treasury will have to offer a real rate of return.

Since our publicly traded debt level is increasing while our personal saving rate is not, we must inevitably rely more and more on foreign creditors to purchase our bonds. The problem is that the Chinese have been net sellers lately, and the Japanese saving rate is chasing ours down the tubes. Europe is also clearly suffering through their own sovereign debt issues. If not the Fed, who then will buy?

At this point, many economists breathe a sigh of relief. Since the Fed has no investment objectives, it could care less how much it loses by buying low-yielding Treasuries. Given that the Fed has an unlimited supply of dollars to buy such debt, it could simply choose to pressure rates lower indefinitely, so long as that policy stance is deemed necessary for a weak economy.

I concede that the Fed can always place bids for US Treasuries, and keep those rates low, but does that mean all debt markets will follow suit? Will private banks continue to offer rock bottom mortgage rates if housing defaults soar or inflation rises? What about the corporate bond market and municipal debt? Can the Fed order a bank to loan to a company at a rate the bank does not find profitable? The only way to keep rates in all debt markets in line would be for the Fed to buy all kinds of debt, not just Treasury debt. Such a policy has never been considered, let alone attempted, by any major economic power.

And what will our foreign creditors think about such a strategy? Anyone with the ability to move investments outside the US dollar would clearly do so, to avoid the wholesale debasement that such an inflationary policy would create. Once you take the argument to its logical conclusion, it is plain to see how futile, ignorant, and dangerous an attempt to hold all rates down would be. Americans can only hope Fed Chairman Bernanke isn’t as foolish as his groupies.

Ask any historian of Germany, Argentina, Bosnia, or Zimbabwe why interest rates skyrocketed during their respective battles with hyperinflation. Why were their central banks unable to control borrowing costs?

In the end, central banks can only temporarily distort the savings and demand equation. The more the Fed prints, the higher the eventual rate of inflation will be. If mainstream pundits truly believe the Fed can supplant the entire public and private market for debt indefinitely, then I don’t want to be around when that fantasy inevitably becomes a nightmare.